Great Valley Advisors Economic & Market Report: The Path Forward for Cryptocurrencies

May 10, 2023

Summary

- Learning about cryptocurrency from the experts in the field.

- Three key takeaways about cryptocurrencies.

- Winners and when.

I recently had the opportunity to attend a two-day conference in Sarasota, Florida hosted by the Global Interdependence Center. The topic was Cryptocurrency and the Future of Global Finance. Given that it included some of the leading research and analysts on cryptocurrencies along with an address from Federal Reserve Board of Governors member Christopher Waller, the event provided a substantive education on a burgeoning segment of capital markets that is otherwise overrun with noise and conjecture. It was a worthwhile and enlightening experience.

My own basic views on cryptocurrencies to this point have been the following. The advent of the blockchain and the supported cryptocurrency systems are almost undoubtedly transformative. The fact that cryptocurrencies have experienced two successive major asset price bubbles first in 2017 and again 2021 is evidence of meaningful future potential in the same way that the dot.com bubble of the late 1990s heralded how the Internet would change the way we live our lives in the more than two decades since. But from where we stand today, several key questions linger. How exactly will cryptocurrencies be transformative, and over what future time horizon will any such changes play out? Also, how will the winners and losers be determined along the way?

The following were some of the key takeaways from the conference:

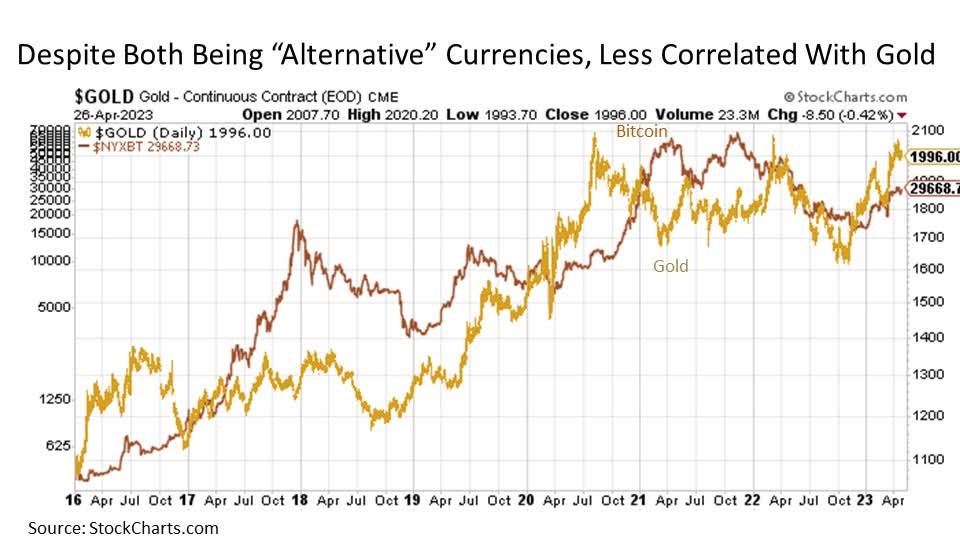

Moves like Apple. While cryptocurrencies are often perceived as potentially viable alternatives to the fiat currencies such as the U.S. Dollar and the Japanese Yen among many others that we have come to know so well over the years, they don’t behave as such at least to date. This is also true of traditional global alternative reserve currencies like gold, as the historical price relationship is generally weak.

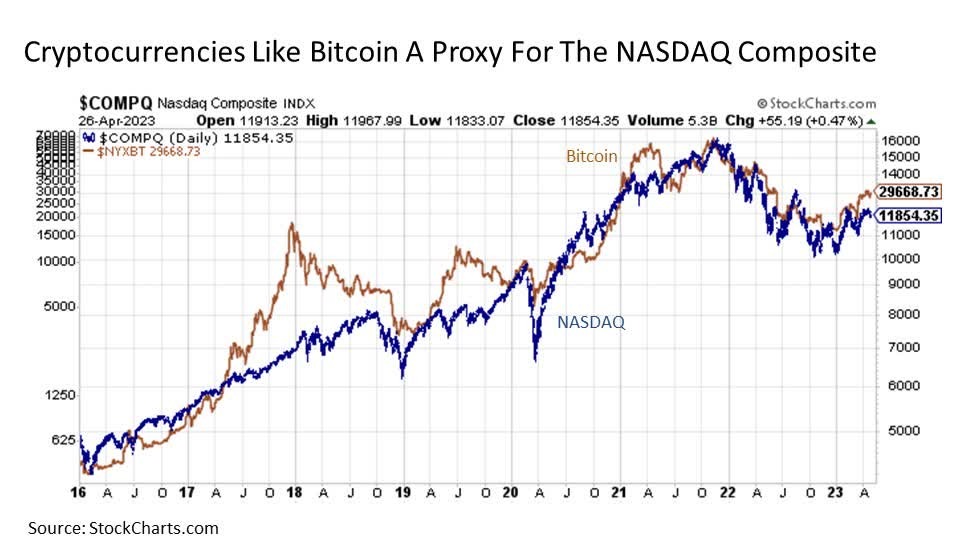

Instead, cryptocurrencies like Bitcoin (GBTC) move with a very high correlation to the tech-heavy NASDAQ Composite Index (QQQ).

So instead of owning something that many might perceive will provide them with a differentiated and more diversified returns experience for their broader “asset” portfolio, those that have added cryptocurrencies like Bitcoin are taking on a risk that is effectively doubling down on the exposures they likely already maintain through holdings in technology stocks.

This is true even for those investors that might perceive they are getting something different to complement their S&P 500 allocation, as a historically high percentage at more than one-third of the headline benchmark is weighted to Information Technology or tech-adjacent sectors such as Communications (that contains former tech juggernauts Alphabet (nee Google) and Meta Platforms (nee Facebook)) and Consumer Discretionary (that contains heavy dollops of Amazon and Tesla).

Put simply, the investors that are crypto curious are often those that tilt toward greater risk and more aggressive equity allocations. And for those that follow through and allocate to crypto, they are effectively ending up with more of the same please from a portfolio allocation perspective.

Disruptive innovation. In many respects, cryptocurrency remains an instrument for speculators seeking to ride the waves of liquidity that have flooded through capital markets in recent years. After all, it is not widely used as a medium of exchange and it does not represent a reliable store of value in any meaningful way. But as we move forward into the future, it is reasonable to wonder about the path of disruptive innovation for cryptocurrencies to ultimately attain this more widespread viability and acceptance. In other words, what should we really be watching in monitoring the progress of cryptocurrency?

First, the path to long-term viability is not likely to happen at the high end of the market. What does this mean? It’s not likely that we wake up one day and Bitcoin is replacing the U.S. Dollar as the way we buy groceries at the market here in America. Why? Because we in the United States are already catered too in many ways. We have the global reserve currency and an overall market system that works pretty smoothly barring the occasional hiccup. Sure, we’ve had some high inflation recently, but it’s not like it’s resulted in a sense of chaos or chronic uncertainty.

The same is true for a more middling case like El Salvador. Here’s a frontier market that made the bold move to adopt Bitcoin as legal tender in 2021. But in unfortunate yet classic top ticking the market fashion, the launch of the Chivo electric wallet in October 2021 took place almost to the date when Bitcoin was reaching its peak over $68,000. Since that time, of course, the cryptocurrency dropped in value by more than -75%. In short, too big of a move way too early.

So where does cryptocurrency find its path to legitimacy? The same way as nearly all disruptive innovations have, which is gaining more widespread usage and acceptance in lower end segments of the global marketplace that are being largely overlooked where profitability is the least and where the need for new ways of doing things like transactions systems is greatest. It is in these low-end segments where the opportunity is greatest for cryptocurrencies to gain widespread acceptance and essentially work out the kinks in broadening actual implementation. As they stabilize and improve, these cryptocurrencies can then start working their way upmarket to more established and developed economies to expand their presence.

This is the most likely path for cryptocurrencies going forward, and it is disruptively innovative transformation that is not going to happen overnight. Instead, it is a gradual evolution that will likely take a good deal of time measured in many years if not a decade or more to play out.

Like Amazon.com and Priceline.com. We have more than 24,000 cryptocurrencies in existence today. And just like the many dot.com stocks that came and went during the late 1990s and early 2000s, it is likely that the vast majority of these cryptocurrencies will follow the same path into extinction in the coming years. What cryptocurrencies then are the likely survivors into the long-run the same way that we still use the services of major companies like Amazon and Booking Holdings (nee Priceline) today?

The consensus view of the experts at the conference is that while others may continue forward into the future, two cryptocurrencies were likely to be the primary survivors into the long-term. The first is Bitcoin due to its size dominance as well as its applicability from a transactions systems standpoint. The second is Ethereum due to its applicability for more specialized applications and contracts.

As a result, these two cryptocurrencies are useful leading proxies for monitoring the broader space for those that may wish to incorporate the monitoring of these assets into their broader asset allocation research.

Bottom line. From an investment perspective, we are likely still several years off from realistically even starting to consider including cryptocurrencies in the context of broader asset allocation modeling. Nonetheless, cryptocurrencies have been evolving for more than a decade now, and this evolution is likely to continue going forward as this pioneering market segment increasingly finds its footing and path toward long-term viability. What that looks like at the end of the day remains to be seen, but it remains worth monitoring as it develops in identifying the associated opportunities once that day arrives. And the insights gained from the recent Global Interdependence Center conference in Sarasota, Florida were ideal in better understanding and focusing this monitoring process going forward.

Leave a Reply

You must be logged in to post a comment.