Cryptocurrency Compass

April 11, 2023

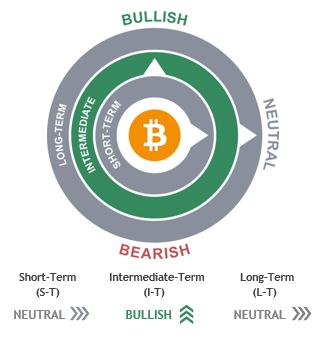

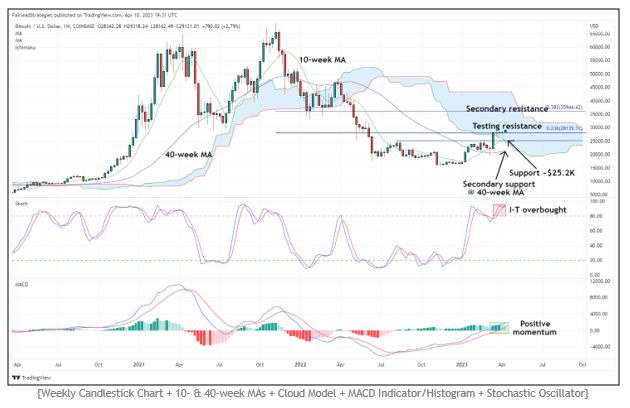

Bitcoin

- Bitcoin is pushing out of a consolidation phase as it tests Fibonacci resistance. The daily MACD is still on a “sell” signal, so we move to a neutral short-term bias to see if the rally holds.

- If a breakout is confirmed above $28.1K this Sunday, we would move to a short-term bullish bias and recommend positioning for a test of secondary resistance near $35.9K.

- Our intermediate-term trend-following gauges point higher, including the weekly MACD, supporting an intermediate-term bullish bias.

- If overbought conditions prevent a breakout, we will turn our focus back to initial support at the March breakout point of ~$25.2K.

- From a long-term perspective, bitcoin is below the monthly cloud with its monthly MACD on a “sell” signal, suggesting it is too early to position for a long-term bullish reversal.

Last Price: $29,131.019

Support: ~$25.2K Resistance: ~$28.1K

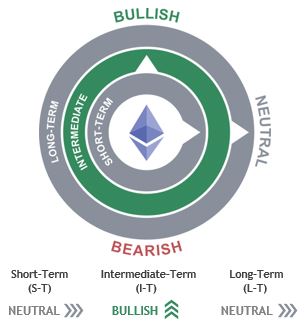

Ether

- Ether has cleared cloud-based resistance (~$1725) in a bullish intermediate-term development, putting the next hurdle on the chart near the psychological level of $2000.

- Our short-term indicators have a neutral posture, suggesting Ether may see near-term digestion before upside follow-through.

- Similar to bitcoin, we hold a bullish bias in the intermediate-term with overbought conditions continuing to be absorbed via positive intermediate-term momentum.

- Support is initially at the March breakout point, near $1670. A pullback would make new positions more attractive given the distance to support. Secondary support is at the 200-day MA.

- We uphold our neutral long-term view, as the monthly stochastics point higher but remain challenged by negative long-term momentum.

Last Price: $1,889.335

Support: ~$1670 Resistance: ~$2000

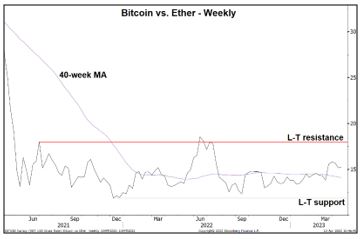

Cryptocurrency Relative Strength

- Bitcoin has pulled back relative to Ether after a breakout in the ratio last month. Nevertheless, we would remain overweight bitcoin versus Ether, noting the ratio is now short-term oversold following its breakout.

- From a long-term standpoint, the ratio has improved momentum per the 200-day MA (not shown), supporting upside follow-through within the wide long-term trading range characterizing bitcoin vs. Ether.

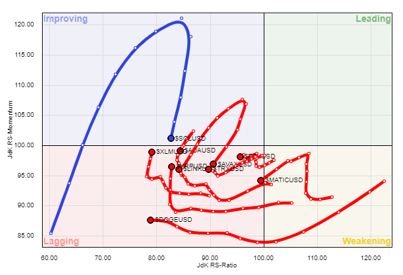

10-day Relative Rotation Graph (RRG®) vs. Bitcoin

We use RRGs to evaluate cyclicality among the top ten altcoins by market cap normalized vs. bitcoin. Stellar, Ripple, and Cardano have rotated out of favor versus bitcoin, while most others have improved from a short-term perspective. We expect altcoins to underperform intermediate-term (see below).

Chart of the Week

The 12-week RRG of the top-ten altcoins versus bitcoin shows that they have rotated out of favor in 2023. Despite improvements in relative momentum for some (e.g., Stellar, Ripple), most remain in the Lagging quadrant, suggesting it is too early to be overweight altcoins. Downturns in Solana, Avalanche, and Cardano are examples of why we would await further improvement from altcoins collectively in the intermediate-term RRG.

Disclaimers and Disclosures

Click here to view the original report shared by Fairlead Strategies.

Cryptocurrency Compass (this “Newsletter”) is a financial newsletter of general and regular circulation published by Fairlead Strategies LLC (“Fairlead Strategies”) on a subscription basis. This Newsletter does not offer individualized investment advice attuned to any specific portfolio or any person’s particular needs. No mention of a particular security, portfolio of securities, transaction or investment strategy in this Newsletter constitutes a recommendation suitable for any specific person. Any reliance you place on such information is strictly at your own risk. BEFORE SELLING OR BUYING SECURITIES, YOU SHOULD SEEK ADVICE FROM A QUALIFIED BROKER OR OTHER FINANCIAL PROFESSIONAL AS TO THE APPROPRIATENESS OF A GIVEN TRANSACTION OR INVESTMENT FOR YOU.

For access to our full disclaimers and disclosures, including our policy regarding editor securities holdings, go to https://www.fairleadstrategies.com/disclaimers-and-disclosures or email [email protected].

Leave a Reply

You must be logged in to post a comment.