Weekly Economic Update by Michael Drury

March 30, 2020

Will second quarter NOMINAL GDP be positive? (Yes, that is all in bold and caps to get your attention.) There has been a wave of dire economic forecasts on real GDP, ranging from -15% to -25% for the second quarter. These are annualized numbers. They mean that volume (inflation adjusted) output will be down -3% to -5% in Q2, and then you raise that change to the fourth power (or multiply by four to estimate) and bam you have a terrible number. However, the cavalry has already been called and a massive money drop of 11% of GDP has already been planned – with the vast majority of that money coming in the second quarter. Will normal spending fall by more than -10% due to the virus? If not, it is possible that Q2 nominal GDP could be positive, as the money drop offsets the virus effects on income — but not production. The result may be a hefty rate of inflation, as hopefully sustained incomes chase far fewer goods. Will a lot of this initial surge in payments be saved? Maybe, but even if real GDP falls -5%, the money drop would allow for a 50% savings rate and still keep nominal GDP in the green. For most, this money drop is to replace normal income needed to pay current bills, not a windfall. We expect savings will be limited.

For the man in the street, the issue is income – and this $2.2 trillion bill attempts to short circuit any reduction in wages and salaries. First, Treasury will provide every adult with an income under $75,000 a one-time payment of $1,200 – regardless of current work status (smaller amounts phasing out for up to $99,000 in income, double those amounts for joint filers and $500 per child). Second, those unemployed (new and existing) will receive normal benefits, plus an additional $600 per week for up to four months. Eligibility rules are relaxed to include self-employed contract and gig workers and the benefit period was extended to 39 weeks from 26. Third, small businesses with less than 500 employees can get loans up to $10 million, with any proceeds used to cover payroll becoming a grant. Will employers’ wage offers have to compete with the elevated unemployment payments to retain workers? In some cases, but workers will also have to make decisions based on short- and longer-term self-interests — in a world of great future uncertainty. Bottom line, we expect much of potentially lost income will be replaced, maintaining stability for much of the economy (think rents, routine monthly payments, medical coverage), though clearly the brunt of the correction will still fall on discretionary spending, like restaurants, travel and big-ticket items, and on the associated manufacturers. These firms will receive most of the $1.1 trillion in business support loans and payments in the bill.

This economic episode is like nothing ever experienced here or anywhere else. Over three million workers applied for unemployment benefits this week – over four times the previous single week record back in 1982. In the entire 2007-2010 period, continuing claims rose 4.2 million. We should reach that number next week. For most of these workers, they will earn more in the next quarter than they would have if employed! However, another 1.4 million typically young seasonal workers would normally be hired over the next four months, and this is unlikely to happen. They likely do not qualify for benefits. Thus, the monthly seasonally adjusted payroll employment numbers will drop by far more than just the increase in claims. If the surge in joblessness is perceived as brief, most will not exit the labor force, so the unemployment rate could quickly spike to 10%. Bottom line, if the economy remains uncertain, we expect even more money will arrive from Washington. In for a penny, in for a pound. We started the stimulus negotiations at $800 billion just last week, and ratcheted up — with a cool 1% of GDP being tacked on at the last-minute Wednesday night to reach $2.2 trillion! Speaker Pelosi is already talking about the next bill.

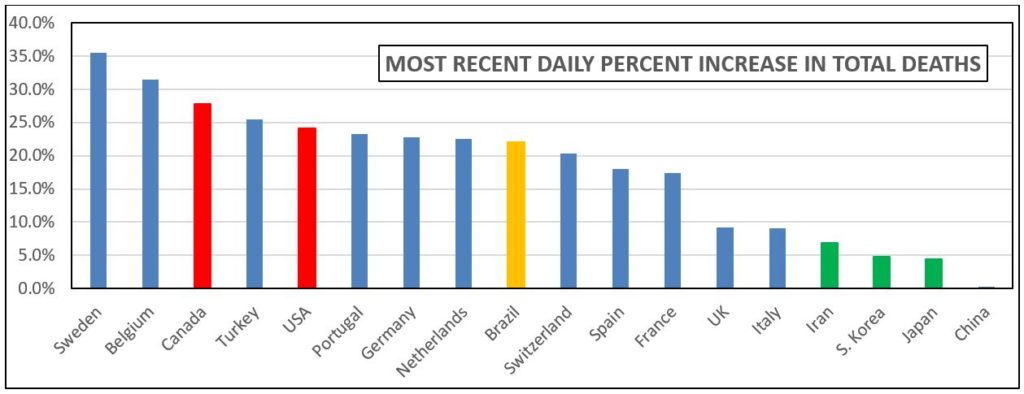

The next significant decision is when quarantines will be lifted, so that at least part of the economy can return to normal. One marker will be the President’s comments – as he clearly is the most optimistic voice of authority. His call for some to re-open next Monday at the end of the initial 15-day study period was quickly kyboshed, and now has been replaced with the hope of a new resurrection on Easter. How biblical – after all, the disease ravaged China for forty days after they shut down Wuhan just before New Year’s Day. However, even that schedule suggests that the end of April is a more realistic early date for the US, given our shutdown started mid-March. Depending on whether the money has arrived, many households and institutions will be facing their second rent or mortgage payment and the pressure will be building for a return to normal. If the US follows the Chinese and Korean experience (where the virus appears under control), by then the number of active cases should have peaked, with daily resolved cases more than matching new illnesses. Europe should have peaked somewhat earlier – starting with Italy — though they may take longer to reopen given the, so far, much greater severity of the disease on that continent. Finally, if warmer weather has any impact on the virus, that, combined with a needed relief from cabin fever, may lead to a shift in sentiment. We are still in relatively early days, but hope springs eternal – especially in the Spring.

The money drop is a social and economic experiment of almost unprecedented scale. It echoes the Chinese stimulus in early 2009, when they injected 4 trillion yuan into what was then a 33.6 trillion-yuan economy, over 12% of GDP. While the rest of the world collapsed, China experienced a single quarter of negative nominal growth (they never reported negative real GDP, but you know…) before returning to 12% real growth (16% nominal) over the next year – roughly their reported running rate before the Great Financial Crisis. For a centrally planned economy running at over 15% nominal growth, that money drop was effectively just front loading a year of planned spending. For a democratic capitalism growing at 4% nominal – with huge deficits already and a massively underfunded retirement era rapidly approaching – spending 11% of GDP is a bit different. In contrast to the Great Depression, when a lack of income and liquidity ground the economy to an extremely painful halt, we are now going to attempt to protect everyone’s income, arguing that no one was at fault (as opposed to in earlier recessions) and hoping the economy can quickly return to is recent robust health as soon as the disease passes. As we have noted before, the nation’s – indeed the world’s — physical and human capital is largely intact, for now, so a rapid recovery is possible.

In our view, the advent of COVID-19 is a 9/11 or Pearl Harbor moment. It draws a sharp line between the peaceful world that existed before (even if there were Cassandra’s that saw it coming) and the massive change and innovation that followed. Pearl Harbor was not the first military event of WW2, nor was 9/11 the first terrorist attack – even in the US. However, both were horrific wake-up calls that the world had significantly changed, and that every business and household would have to adjust. COVID-19 is not the first infectious disease scare of even just this millennium. SARS, MERS, Ebola, Zika, and H1N1 all vied for the title of Disease X, which the WTO had warned us was a coming raging pandemic that would spread through the open globalized fabric of our economies. Pearl Harbor awoke a sleeping giant, unleashing unrivalled manufacturing prowess – and elevated military spending all the way to Vietnam. 9/11 resulted in TSA and trillions of dollars spent on wars in the Middle East to ensure domestic security. Both led to the building of global alliances and shattered periods of regionalism for the US economy – the recovery from the Great Depression, and the ‘90s of the Nikkei Crisis/Asian Crisis/Y2K. Globalism has been in decline since the Great Financial Crisis. Will this virus rally the world to fight together — or will it exacerbate the building of walls?

We should learn a lot about how integrated the global economy is — and will be — quickly. When the trade war started, US firms were faced with how to deal with tariffs. One answer was to leave China, another option was to move deeper in where labor was cheaper. Then came the virus, and many started to think about abandoning China altogether. Now, China is first to recovery – and its stimulus is advantaging those who stayed, while those now in Vietnam, Bangladesh and elsewhere get far less government aid. As recently as September, President Trump was threatening higher tariffs, then new tariffs were waived as past of the Phase One negotiations. Now there are discussions about rolling them back as many small businesses depend on Chinese inputs and the higher prices are an additional burden in an already trying period. Obviously not all agree, as some had begun adjusting to the new tariff world. Where we end up may depend on how quickly the virus is tamed – or not – and if it is likely to return seasonally, like flu. Bottom line, uncertainty reigns and firms will not undertake risk until they have a far clearer path for a foreseeable future. President Trump and Xi were speaking this week, hopefully finding common ground.

How bad might the virus hit our economy? Recent PMI’s indicate that the manufacturing side of the world economy fell into a normal recession in the past month – running around 45. On the service side, which normally holds up better, PMIs collapsed deeply into the 30s. Data from We Bank in China indicates that their economy bottomed at 50% below its normal for four weeks and then recovered over the next five weeks (averaging 25% below normal). That suggests that China lost 3.25 weeks of production during the first quarter or -25%! Annualize that and you get -68%. However, if you return to 100% in the third quarter, you are up by 33% — or 213% annualized!! More simply, if they lose 25% of one quarter and return to normal for the rest of the year, they would be down 6.25% from a supposed roughly 6% growth rate – or basically flat. To us, that’s a victory – and it might be even better with stimulus.

What kind of stimulus is important – and China has a bunch of shovel ready projects (it’s a planned economy), mostly focused on rolling out the 5G network. China Unicom, China Telecom, and China Mobile are all ramping up investment. China looks to have its entire population converted to 5G by 2025. That implies a whole new level of bandwidth and connectivity – and the foundation for a wave of innovation. The Congress is contemplating an infrastructure bill as part of the next stimulus. Let us hope we are not going to be rebuilding aging bridges, roadways and transportation systems in a world that has just learned that work from home and home schooling is the future.

We do see a world of innovation in the aftermath of the virus. The shift to online retail consumption and delivery has advanced significantly as many brick and mortar operations are closed – and many will remain so. The same is true of office space, where firms will certainly re-evaluate the importance of having everyone in one place – especially in densely populated areas where rents are highest. Office space’s future may look like retail real estate now. Will workers get to write off half their rent (or will firms pay it) if they work from home? There are huge tax implications ahead. Schools are also likely to see substantial changes. Some will make up the time recently lost. Others will not. Summer school, online schools, testing, grades and graduation are all likely to face innovations. And changes may be coming to higher education as well, as its dependence on foreign students faces an uncertain future.

The virus has opened our eyes. The world will never be the same. Was the US more concerned about the virus impact on China or Europe? That tells us a lot about where economic integration is the strongest. Which nations are best placed to fight future potential pandemics? Does it take authoritarianism – or just scale and a central authority? Will future trade blocs be stronger or weaker? Is China allying with Europe, and isolating the US? A lack of savings and too much leverage was a big reason for this massive US stimulus. How will incentives change to limit a repeat? Will weaker firms ever be able to borrow after this? If a borrower came to you needing funds after this massive a money drop, would you lend to them? At what premium? Are higher inflation expectations and interest rates a sure thing? How will P/E ratios react? If inflation is back, will commodities and real estate outperform equities? Will consumers demand lower prices, while labor asks for a growing share of the pie, as households seek to build precautionary balances? Who will gain a growing share of the economy? We doubt we are returning to the pre-virus order. There is plenty of fodder here for future McVean Weekly Economic Updates.

All readers are invited to go to www.interdependence.org to register for a free webinar on April 2 @ 4 PM EST, featuring McVean Trading’s Chief Economist, Michael Drury, discussing the economic recovery in China, and Mei Mei Hu, CEO of United Neuroscience, who will discuss COVID-19 testing and vaccine developments and share insights from her firm’s fight against the COVID-19 battle earlier in the year. This is the second in the series of executive briefings — Analyzing Pandemics: Economic & Policy Impacts. A replay of the first webinar is available, featuring Jeffrey Gold, MD, Chancellor of the University of Nebraska Medical Center, one of our nation’s top facilities on infectious disease, which handled early cases of Ebola and COVID-19.

Leave a Reply

You must be logged in to post a comment.