The Long Haul

July 9, 2021

The U.S. economy is expected to surpass pre-pandemic levels this quarter. Economists project by the end of 2021 gross domestic product will reach the path it was projected to follow had the pandemic never happened.[1]

The pandemic’s long-term impacts may take many forms, positive and negative. In the “plus” column, the pandemic accelerated technological change, meaning that productivity growth and GDP are likely to remain above pre-pandemic levels. In our view, investment in digital infrastructure – particularly those that support 5G technology – will create jobs and business applications that haven’t yet been imagined. In our view, skill and talent training, already underway pre-pandemic, will likely accelerate as workers reskill, and universities and corporations reform.

Two factors top our “minus” column. The first is swelling global debt issued to fund $16 trillion of global stimulus since the start of the pandemic. Excessive borrowing is driving the so-called “fast forward” business cycle, stealing growth opportunities from the future. The magnitude of permanent fiscal damage is a growing uncertainty for investors.

The second important factor is long-haul Covid or long Covid. The symptoms of long Covid appear in various organ systems, occur in chaotic, diverse patterns, and frequently get worse after physical or mental activity, like work. The long Covid experience – severe breathlessness, fatigue, and “brain fog” (among others) – is similar to conditions such as Lyme disease syndrome, Epstein-Barr virus, and chronic fatigue syndrome (CFS).

Early studies from the U.K. and Norway show long Covid lingers for at least three months or longer and the average age of patients with long Covid is about 40. This means that the majority are in their prime working years.

The Centers for Disease Control and Prevention (CDC) estimates that more than 114 million Americans had been infected with Covid-19 through March 2021. Factoring in new infections in unvaccinated people (35% of Americans may ultimately choose to build immunity the hard way), more than 15 million cases of long Covid are expected to result from the pandemic. [2]

Given these demographics, long Covid is likely to cast a long shadow on the health care system and the trajectory of the economic recovery in the U.S. and globally.

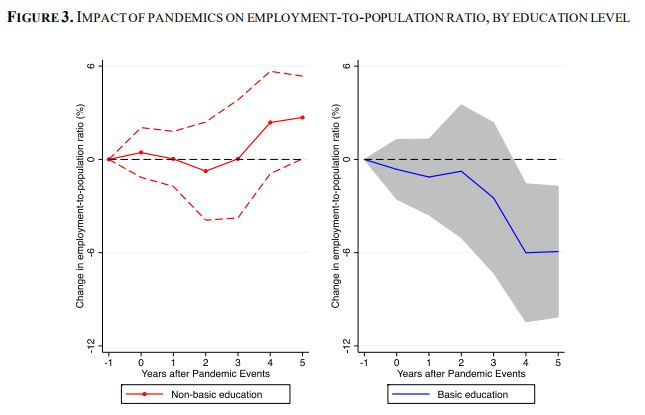

A recent IMF Working Paper sheds light on the possible medium-term economic impacts from the Covid-19 pandemic by studying evidence from past pandemics. A key finding is employment-to-population ratios decline (see graph below). We interpret this as a rising dependency ratio (fewer workers per elderly and youth), supporting RiskBridge’s outlook for sustained higher inflation.

Sufferers of long Covid continue to struggle with the immune disorder, but there is help. At least thirty-three U.S. hospitals and health systems have created Covid-19 recovery programs, or post-Covid clinics to support patients who experience lingering symptoms weeks or months after being cleared of the illness. This is not an exhaustive list[3] but we hope it serves as a useful reference to those looking for answers.

1. Cleveland-based MetroHealth

2. Los Angeles-based Cedars-Sinai

3. Browns Mills, N.J.-based Deborah Heart and Lung Center

4. Edison, N.J.-based Hackensack Meridian Health

5. Westchester (N.Y.) Medical Center

6. Fullerton, Calif.-based St. Jude Medical Center

7. UAB Medicine in Birmingham

8. Concord, Mass.-based Emerson Hospital

9. New York City-based Mount Sinai Health System

10. UChicago Medicine

11. Aurora, Colo.-based UCHealth

12. San Francisco-based UCSF Health

13. Philadelphia-based Penn Medicine

14. Morristown, N.J.-based Atlantic Health System

15. Boston-based Spaulding Rehabilitation Hospital.

16. New York City-based Montefiore Medical Center.

17. Louisville, Ky.-based Norton Children’s Hospital

18. Yale New Haven (Conn.) Hospital

19. University of Maryland Baltimore Washington Medical Center

20. Chicago-based Rush University Medical Center

21. Cedar Rapids, Iowa-based Mercy Medical Center

22. Cleveland Clinic

23. Oregon Health & Science University in Portland

24. Houston-based Baylor College of Medicine

25. Hartford (Conn.) HealthCare

26. Galveston, Texas-based UTMB Health

27. Fort Wayne, Ind.-based Parkview Health

28. St. Louis-based Washington University School of Medicine

29. Washington, D.C.-based George Washington University

30. Bethlehem, Pa.-based St. Luke’s University Health Network

31. Philadelphia-based Temple Health

32. New Brunswick, N.J.-based Saint Peter’s Healthcare System

33. Danbury, Conn.-based Nuvance Health

To conclude, we believe the pandemic will abate, which is great news, but the virus itself is likely to survive, casting a long shadow on the pace and shape of the economic regime over the coming quarters and years.

[1] The Wall Street Journal, “The Economic Recovery is Here. It’s Unlike Anything You’ve Seen.,” June 2, 2021.

[2] The New England Journal of Medicine, Perspective, Confronting Our Next National Health Disaster – Long Haul Covid, S Phillips, M.D., MPH, M Williams, Sc.D., June 30, 2021.

[3] BeckersHealthcare.com

DISCLOSURE:

Past performance is no guarantee of future results. This Risk Report has been prepared by personnel of RiskBridge Advisors, LLC (“RiskBridge”). The views expressed herein do not constitute research, investment advice, or trade recommendations. RiskBridge may, from time to time, participate or invest in transactions with issuers of securities that participate in the markets referred to herein, perform services for or solicit business from such issuers, and/or have a position or effect transactions in the securities or derivatives thereof.

This Risk Report is distributed for informational purposes only. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and RiskBridge makes no representation as to its accuracy or completeness. Any opinions, recommendations, and assumptions included in this material are based upon current market conditions, reflect the judgment of RiskBridge as of the date indicated, and are subject to change without notice. You acknowledge and agree that in making the information available, RiskBridge is under no obligation to provide any additional information or to update such information. Securities and/or indices highlighted or discussed in this communication are mentioned for illustrative purposes only and should not be construed as investment recommendations. All investments involve risk, including the loss of principal. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. Risk Report and this information are not intended to provide investment, tax, or legal advice, and this material is not to be relied upon in substitution for the exercise of independent judgment. This Risk Report is not to be reproduced, in whole or part, without the written consent of RiskBridge.

Leave a Reply

You must be logged in to post a comment.