How Much Are We Worth?

June 5, 2014

The Federal Reserve recently announced that U.S. consumers were now wealthier than at any time in history, this in spite of the weakest recovery from the worst recession since the 1930s. This seems to characterize many if not most of the industrialized countries. Asset prices are rising, but the real output of these assets is not. This makes no sense, and when this is the case, markets tend to adjust to resolve the inconsistency. In this case, either output must rise to justify high valuations, or valuations must fall to square up with the actual output countries and companies are producing.

To calculate my net worth, I have to figure out the value of all my assets and then subtract the total amount of my liabilities (debts and promises). To start, I would list my physical assets: one home, two well used cars, three TV sets, the family silverware, my wife’s engagement ring, some tools, 100 shares of Intel (ownership of a small fraction of Intel’s productive assets), a few 10-year government bonds, one gold coin, a used boat, etc. You get the picture, a list of the real things I own. My debts, denominated in dollars, are clear. To value my assets, I must assign a value (price) to each item, multiply by the units I own and add it up. That’s my total assets. Subtracting my debts yields my net worth.

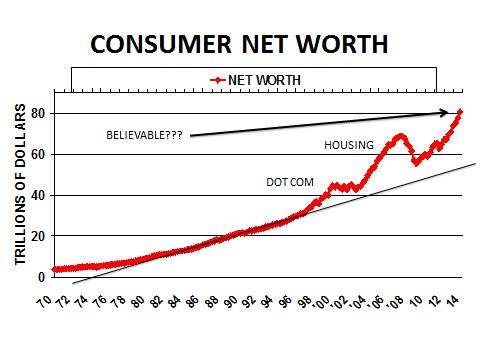

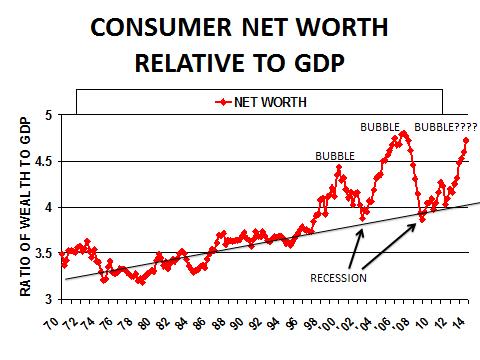

In principle, this is how the government does it for an entire economy. The chart below shows the growth (and sometimes decline) of U.S. net asset value since 1970 (This does include “non-profits,” but they hold many of the same types of assets). One conclusion from a cursory look at the charts below (with illustrative pre-2000 trend lines) might be: “Let’s have another great recession; look at the increase in wealth it produced.” Then a second thought, one might wonder why we have had such a lousy economic recovery with so much new wealth. Some might respond: “The top 1 percent have all the wealth and don’t spend it; they own all the assets like stocks and bonds and big houses that have appreciated so much.” But many more own stocks and bonds and houses and cars and other assets than the top 1 percent. A lot of people should be spending at least a little bit more now that they are wealthier.

Then one might consider the possibility that the value (prices) we assigned to the stuff we own might be wrong, that markets have been so interfered with that we no longer really know what “real value” is and can’t figure out what we are really worth. Do we really have a lot more stuff, real wealth, or do we just think what we have is more valuable? Can we really have deviated so far from a three-decade wealth growth trend line and be so much wealthier? I have my doubts. Central banks everywhere are distorting interest rates and supporting inflated valuations. Currencies, bonds, stocks, deeds, titles, etc., are all paper claims. Ultimately, our wealth is measured by how much stuff we can acquire with it and how much the assets we own can produce. I’m not sure we’re worth all that the statistics say we are ($80 trillion in the U.S.).

Leave a Reply

You must be logged in to post a comment.