Crypto and Risk Allocation

February 17, 2023

A pirate ship races to capture a bright sun on the horizon.

Chasing Sunsets

Do cryptocurrencies have a place in the asset allocation process? This was the question posed to RiskBridge at the Digital Money, Decentralized Finance, and the Puzzle of Crypto conference hosted by the Global Interdependence Center and held in La Jolla, CA, on February 10.1

To set the context for the conference, we encourage you first to watch the prepared remarks made by Christopher Waller, Governor of the Federal Reserve Board2and read the speech delivered by Patrick Harker, President and CEO of the Federal Reserve Bank of Philadelphia3

In short, RiskBridge could include cryptocurrencies in client portfolios, but we don’t.

The framework used by RiskBridge to assess the investment worthiness of crypto is the same discipline we use for all assets. For an asset to be considered a possibility or prospect for a RiskBridge portfolio, it must pass three filters:

First, how does the asset fit inside our risk allocation approach? Does the asset provide diversification, help control risk, or enhance portfolio utility? How much portfolio risk budget is consumed by adding a cryptocurrency?

Next, can we measure the asset’s intrinsic value or equilibrium price? Is there a clearly defined use case? Can we monitor the asset’s supply and demand? Is there a measurable cash flow stream producing a net present value calculation?

Finally, and most importantly, is the asset compatible with RiskBridge’s fiduciary responsibility to our clients? Is it an investment or mere speculation? Can we get comfortable with custody, operational, regulatory, and reputational risks?

Risk Allocation

RiskBridge is an allocator of risk. We spend disproportionate analytical time aligning investment portfolios with each client’s unique risk profile and financial objectives. We do this by employing a technique known as risk targeting (or volatility targeting).

Risk targeting is an investment strategy that aims to maintain a specific level of portfolio volatility, regardless of market conditions. It is designed to provide investors with a predictable risk and commensurate return. The main objective of risk targeting is to provide investors with a predictable level of risk to manage their expectations better and make informed investment decisions. Volatility targeting involves adjusting the allocation of assets within a portfolio in response to changes in market volatility. This can include reallocating from lower-volatility assets to higher-volatility assets to maintain the desired level of volatility. The benefits can provide investors with a more consistent level of risk and return compared to traditional investment strategies and can help reduce the risk of significant losses during market turbulence. Risk targeting can be implemented using a variety of investment vehicles, including ETFs, mutual funds, individual stocks and bonds, and private placements.

Whether it is cryptocurrencies or any traditional asset, we must be able to measure each asset’s

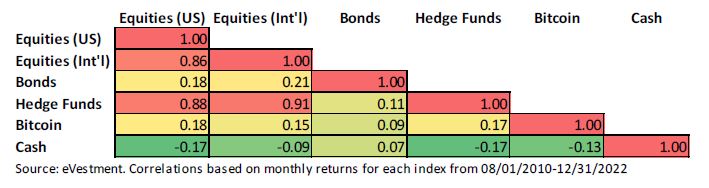

(1) correlation to other assets in the portfolio, (2) expected volatility or annualized standard deviation of return, and (3) expected return. The challenge with developing projected capital market assumptions (risk and return) for cryptocurrencies is that there simply is not enough history. The sample size is too small.

In the analysis below, we use bitcoin as the proxy for cryptocurrency. Out of the +20,000 crypto coins available, bitcoin has the longest price history. Our study uses monthly bitcoin prices starting 08/01/2010 and ending 12/31 2022 (151 monthly observations).

The table below illustrates the price correlation between bitcoin and several primary asset classes. We observe low correlation coefficients between bitcoin and traditional asset classes. This suggests there may be some diversification benefits from adding bitcoin to a diversified portfolio. Score cryptocurrencies (+1) for diversification.

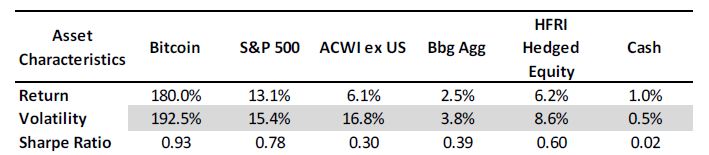

The next exhibit shows each asset class’s annualized return, volatility, and Sharpe ratios. For the measurement period, bitcoin had the highest risk (price volatility) and return. Any asset optimization model will want to direct capital towards those assets with the highest return for each unit of risk (Sharpe ratio). In this example, bitcoin, US stocks, and equity hedge funds generated the highest Sharpe ratios. Score +1 for cryptocurrencies.

Past performance does not guarantee future results. Source: Bloomberg. Asset returns and volatilities (annualized standard deviation of returns) are based on annualized monthly returns from 08/01/2010 through 12/31/2022. 3-month T-Bill used for cash returns and risk-free rate for the Sharpe ratio calculation.

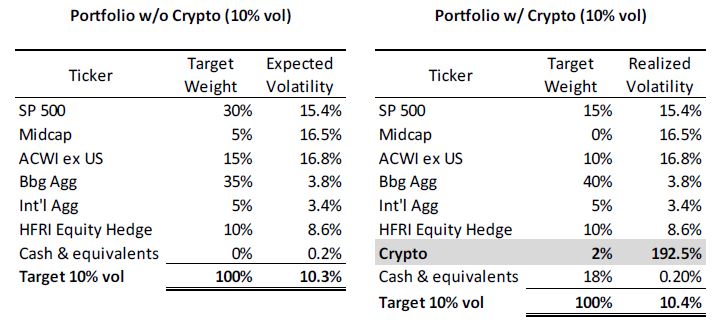

Below we provide a simple illustration of the impact cryptocurrencies – in this case, bitcoin – would have on a risk-targeted portfolio. The panel below shows two portfolios. Both portfolios are constrained to produce a 10% volatility (what RiskBridge considers “moderate”). Bitcoin is excluded from the portfolio on the left and included on the right.

Bitcoin’s annualized volatility (192.5%) is outsized relative to realized volatility of the other assets. What this means is that bitcoin is a risk budget hog. As such, an investor is faced with (1) taking an abnormally small position size in the cryptocurrency (2%) and (2) having to decrease (or eliminate) allocations to other risky assets while increasing allocations to low-risk assets, including cash.

Past performance does not guarantee future results. For illustration purposes only. The table does not represent an actual client portfolio. Source: RiskBridge, Bloomberg. Each portfolio is constrained, and target weights are selected to generate an expected volatility of 10%. Expected volatility represents the realized annualized standard deviation of return for each asset index for the period starting 08/01/2010 and ending 12/31/2022. An investor cannot invest in an index directly.

While bitcoin and other cryptocurrencies may offer the benefits of low correlations, in our view, cryptocurrency volatility consumes too much of a portfolio’s risk budget and generates a suboptimal portfolio structure. We score cryptocurrencies (-1) and crypto technology (+1) for risk targeting.

Valuation Test

RiskBridge must have a reasonable basis for investing in crypto assets. Speculation is not enough.

RiskBridge performs fundamental analysis to estimate the value of an asset, compare the calculated value to the market price, and then base investment decisions on that comparison. We use present value models, multiplier models, and asset-based valuation models to generate an intrinsic value.

Determining an intrinsic value of a cryptocurrency is an arduous task. Cash flows, earnings, or balance sheet assets are either nonexistent, loosely defined, or errantly reported.

If we cannot use any form of discounted cash flow analysis to value crypto, there must be a suite of permanent users and usages that constitutes the bedrock of why cryptoassets have value, at least for these users.

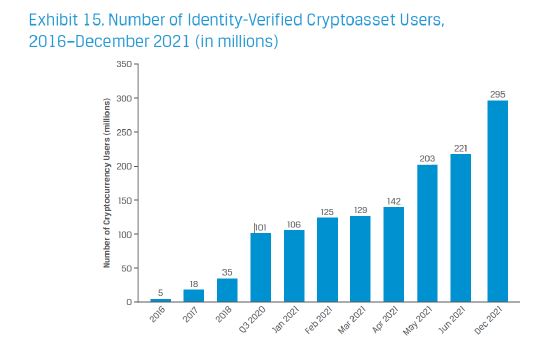

The table below, sourced from the CFA Institute, suggests there were 295 million global users of cryptocurrencies in 2021.4

There are approximately 21,910 cryptocurrencies with a total market capitalization of $850 billion as of December 2022. We are skeptical that the world needs that many digital tokens (or even another fiat currency). Even with this level of product proliferation, the clearest use case to date for cryptocurrencies is investment speculation and funding for illicit activities.

As a means of exchange, we can use fiat currencies (USD, EUR, JPY) as a baseline. The challenge here, however, is that there are no data points, such as interest rate differentials or underlying economic conditions, to speak of, particularly when attempting to determine momentum or future demand. Technical analysis is probably the most effective way of measuring the supply and demand of the use case for cryptocurrencies.

In our view, the equilibrium price of cryptocurrencies is most logically related to analyzing use cases for these instruments or how participants use them. In our judgment, cryptocurrencies fail a practical use case test as of January 2023. This may change over time. For now, cryptocurrencies serving as a store of value, a medium of exchange, or an alternate form of money is more hope and hype than reality.

We consider the use case for cryptocurrencies separate from the use case for the technology that underpins crypto assets and decentralized finance (defi).

In our view, we think the use case for crypto-based technology is materially more significant. This includes “tokenizing” real economic assets and processes, smart contracts, decentralized finance, lending, and borrowing. These fintech solutions could transform construction and commercial real estate contracting, custody/clearing/settlement businesses, securities exchanges, and investment banking. This is the equivalent of betting on the merchants of the “picks and shovels” during the California Gold Rush.

In sum, without the ability to assess market price against an estimated intrinsic value, cryptocurrencies fail the valuations test. Without the ability to generate fundamental valuation analysis, technical analysis is the readily available research to identify price trends and patterns.

For valuation, we score cryptocurrencies (-1) and crypto technology like blockchain and distributed ledger technology (+1).

Fiduciary Test

RiskBridge requires any investment to have a reasonable basis to be added to a client portfolio. Mere speculation is not enough.

Fiduciary duty is based on general principles rather than prescribed sets of specific rules. The two core principles are a duty of loyalty and a duty of care (called prudence in trust law). The duty of loyalty requires fiduciaries to act solely in the best interests of their clients or beneficiaries who, collectively, are owed the fiduciary duty. Fiduciaries must act prudently in their investment decisions and advice.

Crucially, the “prudent investor rule,” which prevails in the United States, does not prohibit investments in any particular asset class or type of investment per se. Instead of categorically banning certain types of investments or investing strategies, the “prudent investor rule” requires fiduciaries to have “an overall investment strategy having risk and return objectives reasonably suited to the trust” and generally to “diversify the investments of the trust.”

Governor Waller highlighted in his speech that at least 15 public pension funds, which manage public employee retirement funds, had investments in the now-bankrupt crypto-asset exchange, FTX.5

RiskBridge would like to understand how 15 pension boards and investment committees concluded that FTX was “reasonably suited” for their plans.

The challenge for fiduciaries is formulating concrete process requirements to achieve a fiduciary standard for digital assets.

- RiskBridge cannot yet find a reasonable basis for investing in However, we see crypto technology’s risk and valuation characteristics (blockchain, etc.) as a reasonable fit in our venture and co-investment categories.

- The extreme annualized volatility of cryptocurrencies is not a prudent fit with the RiskBridge risk-targeting approach to asset allocation.

- Custodial challenges exist for most crypto assets (cryptocurrencies, NFTs, ICOs, digital wallets). Digital assets may be held in custody at traditional banks (State Street, BNY Mellon, US Bank, Fidelity, Nomura), banks that partner with new custody vendors (Citi, Barclays, ING, Barclays), and tech-only solutions (Anchorage, Bakkt, BitGo, Coinbase, Fidelity Digital Assets, Gemini, and Kingdom Trust). Several key unresolved questions need “time and space” to get worked out, including the segregation of client funds and

- Laws and regulations governing crypto assets and platforms are still New laws and regulations will undoubtedly significantly impact the crypto industry and particular platforms, products, and participants. Again, the unpredictability of that impact could raise questions about the prudence of participating on crypto platforms or investing in crypto assets at this stage.

- The Department of Labor guidance (2022) begins with a warning: “The Department cautions plan fiduciaries to exercise extreme care before they consider adding a cryptocurrency option to a 401(k) plan’s investment menu for plan ” The DOL then discusses distinguishing features of cryptocurrencies that it suggests could conflict with a plan’s fiduciary duties, including speculative and volatile investments, valuation concerns, the challenge for plan participants to make informed investment decisions, custodial and record-keeping concerns, and an evolving regulatory environment.

From a fiduciary perspective, we score cryptocurrencies (-1) and crypto technology like blockchain and distributed ledger technology (+1).

Conclusion

In conclusion, RiskBridge sees investment opportunities and possibilities in cyber technology through our asset allocation’s venture capital and co-investment segments. We could include cryptocurrencies in client portfolios, but we don’t for the same reasons we don’t invest or speculate directly in fiat currencies: there is no prudent rationale to do so for RiskBridge’s institutional and individual clients.

There’s also a philosophical reason for not speculating on cryptocurrencies. RiskBridge believes a decade of central bank experimentation gave us cheap money and artificially low interest rates, creating an environment where many unworthy businesses received access to capital. In our view, the Fed’s hyper-aggressive monetary policies drove the party bus that dropped off fracking, Airbnb, S&P 4600, a $26 million digital Bored Ape, and 20,000 cryptocurrencies.

If the Fed is indeed unwinding its great monetary policy experiment, then the same party bus is leaving the station. History will judge if stewardship, reliability, and prudence return to capital markets, including crypto.

Past performance is no guarantee of future results. Personnel of RiskBridge Advisors, LLC (“RiskBridge”) prepared the Risk Report. The views expressed herein do not constitute research, investment advice, or trade recommendations. RiskBridge may, from time to time, participate or invest in transactions with issuers of securities that participate in the markets referred to herein, perform services for or solicit business from such issuers, and/or have a position or effect transactions in the securities or derivatives thereof.

All references to index funds and other economic indicators contained herein are provided for illustrative purposes only. Investors cannot invest in an index, and indexes do not reflect the deduction of advisor’s fees or other trading expenses.

This Risk Report is distributed for informational purposes only. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and RiskBridge makes no representation as to its accuracy or completeness. Any opinions, recommendations, and assumptions included in this material are based upon current market conditions, reflect the judgment of RiskBridge as of the date indicated, and are subject to change without notice. You acknowledge and agree that RiskBridge is under no obligation to provide any additional information or update such information in making the information available. Securities and/or indices highlighted or discussed in this communication are mentioned for illustrative purposes only and should not be construed as investment recommendations. All investments involve risk, including the loss of principal. Before implementing any strategy, consult a qualified financial adviser and/or tax professional. Risk Report and this information are not intended to provide investment, tax, or legal advice, and this material is not to be relied upon in substitution for the exercise of independent judgment. This Risk Report is not to be reproduced, in whole or part, without the written consent of RiskBridge.

Risk Report, February 2023

1 RiskBridge proudly sponsors the Global Interdependence Center (GIC). The GIC is an independent nonprofit organization dedicated to exploring global, interdependent topics and policies impacting world economies and living standards. GIC hosts neutral, nonpartisan forums bringing together a network of global experts in policymaking, central banking, industry, and academia.

2 https://www.youtube.com/watch?v=KUTUhZk3CNc

3 https://www.philadelphiafed.org/the-economy/monetary-policy/230210-the-changing- payments-landscape-in-a-period-of-pandemic-recovery.

4 S Deane, O Fines, “Cryptoassets: Beyond the Hype; An Investment Management Perspective on the Development of Digital Finance”, CFA Institute (January 2023).

5 Waller, Christopher. “Thoughts on the Crypto Ecosystem.” Conference Presentation at The Conrad Prebys Performing Arts Center, La Jolla, CA, February 10, 2023.

Leave a Reply

You must be logged in to post a comment.