A Look at Domestic Corporate Profits

June 3, 2014

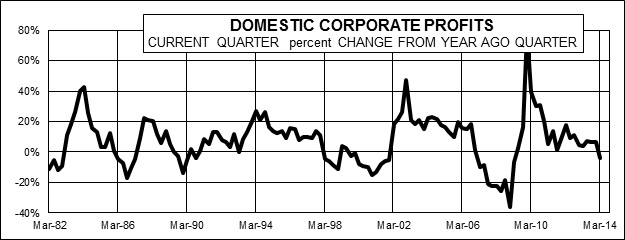

In a capitalist economy, the key leading indicator is profits. With real GDP growth in the first quarter revised down to -1.0 percent and nominal GDP (or business revenues) up a scant 0.3 percent, sustained hiring meant corporate profits plunged at a stunning -34 percent annual rate. Profits now stand -4.0 percent below a year ago – a traditional signal of the late cycle, as recessions typically begin roughly a year after that occurrence. A big bounce in profits is likely in the second quarter, as nominal GDP should exceed compensation by 2 percent (likely 5.5 percent vs. 3.5 percent), which would translate into roughly a 20 percent annualized increase. However, profits grew at a 16 percent annual rate in 2013 Q2, and then north of 5 percent in the second half as margins widened. Bottom line, even after a bounce, if rising wages narrow margins profits in the second half, profits will remain negative compared to a year ago.

Over the past three cycles, profits spiked early as government stimulus fed through to sales with little initial increase in hiring. After the initial spike, profits growth moderated. In the 1980s, a pause that refreshed came two years after the initial spike, but profits succumbed again 22 quarters after the spike – and recession was declared a year later. In the 1990s, there was a 16 quarter gap between the peak in annual profit growth and the first negative. A slump came that was associated with the Asian crisis, but Y2K and the tech boom gave a brief respite and recession was declared six quarters after the second drop into negative profits. In the new millennium, profits fell 17 quarters after the initial spike, and recession was called one year later. Once again, we are 17 quarters after the initial spike in profits, and apparently headed for a year of negatives. With few excesses in the economy, we expect a shallow period of negative profits, like in 1990, and a mild recession to follow – perhaps only a growth recession (less than 1 percent growth). Bottom line, we feel increasingly certain the die is cast. Corporate CEOs are likely to begin to respond to weaker than expected profits with new rounds of cost control, and there is no stimulus left from monetary or fiscal authorities that is likely to change their minds. A further shake out in financial markets as weakened debtors falter is likely to be the focus of the correction, rather than sharply lower output.

The preceding is an abridged version of a commentary for McVean Trading and Investments, LLC and has been reposted here with permission of the author.

The ideas and opinions expressed in this blog are those of the author, and they should not be perceived as investment advice or as any other kind of advice.

Leave a Reply

You must be logged in to post a comment.